TEXAS TECH CREDIT UNION

cruise into

summer

Known for innovation and purpose, TTCU partnered with Primitive to elevate their auto lending promotion, ensuring in-market buyers not only saw their offer but felt confident choosing a credit union that puts people first.

getting people

excited about

auto loans

+ THE CHALLENGE

With more loan options than ever, buyers expect a standout experience. Texas Tech Credit Union partnered with us to elevate its “Cruise into Summer” auto lending promo to reach in-market buyers and accrue qualified applications.

+ Objectives

+ Our Strategy: Cruise into Summer

+ Channel + Targeting Roadmap

In collaboration with our media execution partners, Pathlabs, we built a strategic media plan targeting in-market buyers, recent grads, and refinancing prospects. Using layered geo and demographic targeting, we activated Meta, YouTube, Display, and Search to multiply awareness and conversion across the funnel.

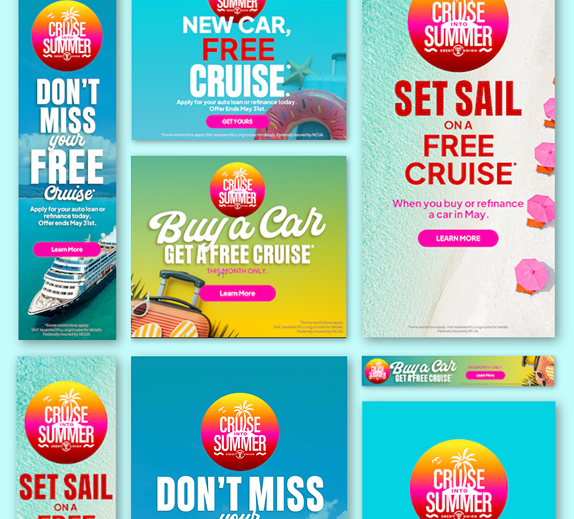

Social Ads

Social ads offer precision targeting and strong visual impact, making them ideal for reaching in-market buyers where they scroll. For TTCU’s campaign, we recommended Meta ads to tap into high-intent audiences with compelling creative, boosting both awareness and application volume in a cost-effective way.

.png?width=574&height=514&name=Rectangle%208%20(1).png)

GOOGLE ADS

When users are actively searching, timing is everything. That’s why we leveraged Google Display and Search Ads to place TTCU in front of high-intent audiences exactly when they were looking for auto loans or refinancing. These targeted campaigns helped usher in qualified traffic and encouraged action right at the decision-making moment.

Programmatic Ads

Programmatic ads allowed us to scale reach and precision simultaneously. Using data-driven targeting, we served display ads to audiences based on online behavior, interests, and intent signals. For TTCU, this meant staying top-of-mind with potential auto loan customers across the web, well before they even hit search.

.jpg?width=2000&name=BodyImage2%20(1).jpg)

+ RESULTS

Through strategic optimization and effective media management, the campaign helped achieve:

- 125% Growth in Auto Loan Production, surpassing our goal by 31%.

- 10% Reduction in Acquisition Costs improving efficiency across the funnel

- 3,000+ Landing Page Sessions driving digital engagement

- 800+ Direct Branch Visits converting interest into in-person action

This campaign effort not only achieved short-term acquisition goals but also helped create a foundation for long-term member engagement and future cross-sell opportunities.